DoW's 8(a) Sole-Source Review: Implications and Action Steps for 8(a) Owners and Small Business Executives

By WALLY ANGEL, ROSE FINANCIAL SOLUTIONS

As we head deeper into 2026, 8(a) firm owners and small business executives focused on government contracting—especially with the Department of War (DoW, formerly DoD)—are navigating significant changes.

On January 16, 2026, Secretary of War Pete Hegseth announced an immediate line-by-line review of every sole-source 8(a) contract exceeding $20 million in the DoW. He described the 8(a) program as the federal government's oldest DEI initiative, citing concerns over fraud, pass-through schemes, and contracts that fail to enhance military lethality. This builds on President Trump's Executive Order 14151 (issued January 20, 2025), which terminated many DEI-related programs, preferences, and activities across federal agencies, and reset small disadvantaged business goals to the statutory 5%.

While the 8(a) program—rooted in the Small Business Act—remains statutorily protected and open for business per the SBA, the DoW's targeted scrutiny could affect billions in awards. In FY 2025, the DoW directed $15.5 billion through 8(a), often in sole-source deals up to $100 million for areas like IT, engineering, and logistics. Hegseth emphasized that reviews will prioritize whether contracts support warfighting priorities, with potential for terminations, renegotiations, or enforcement against non-compliant arrangements (e.g., violating FAR 52.219-14 subcontracting limits of typically 15-50%).

I've supported 8(a) firms for over 20 years, helping executives build compliant, resilient operations amid FAR complexities and policy shifts. This article combines key insights to provide clarity on the implications and practical steps forward.

The Current Landscape

The 8(a) Business Development Program helps socially and economically disadvantaged small businesses access federal contracts, including sole-source awards without competition. Hegseth's announcement highlights longstanding issues: some firms allegedly act as intermediaries, subcontracting most work to larger entities (often "Beltway Bandits") while retaining fees, leading to waste and limited actual small business performance.

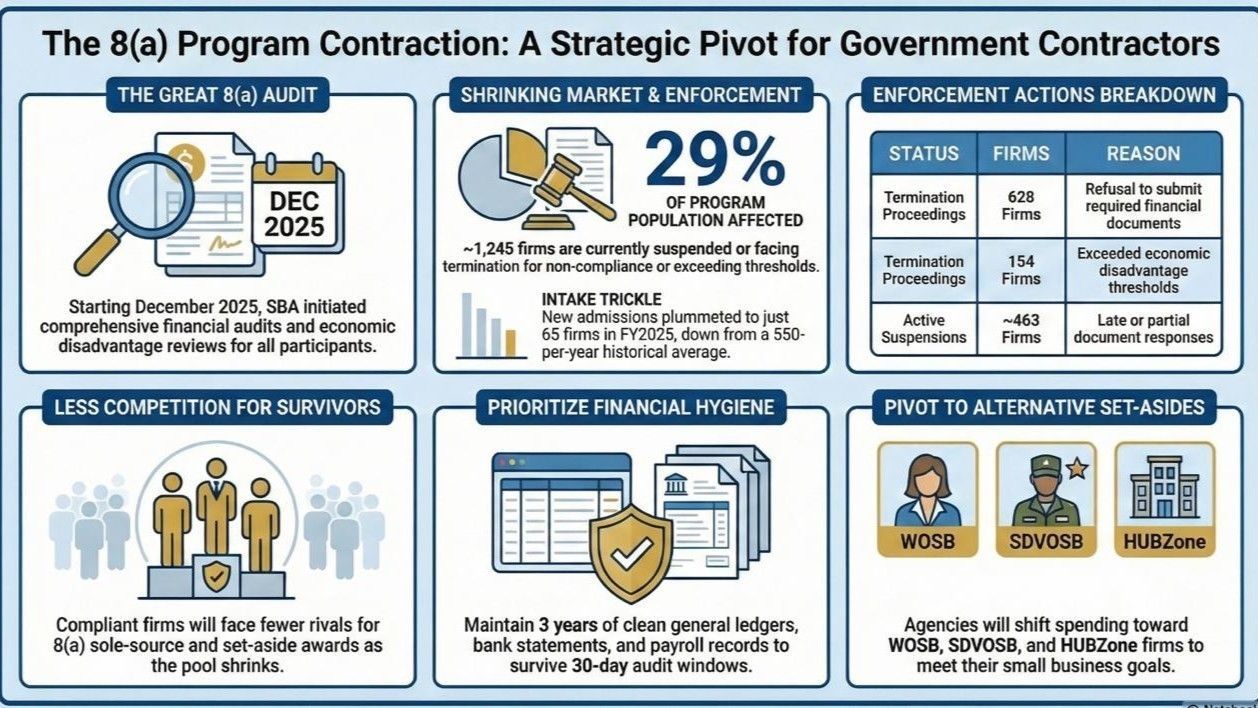

This DoW-specific review aligns with broader efforts, including SBA audits requiring financial records from all participants (with deadlines in early 2026) and agency-wide scrutiny. No blanket halt exists, but heightened oversight means DoW contracts face the most immediate pressure.

Key Implications for Your Firm

- Audit and Compliance Risks: Large sole-source contracts will undergo detailed examination for fraud indicators, subcontracting compliance, and value alignment. Non-compliance could trigger contract terminations, False Claims Act exposure, or debarment.

- Opportunity Shifts: Reduced emphasis on DEI-linked goals may push agencies toward competitive bids or other set-asides (e.g., SDVOSB, HUBZone), potentially contracting sole-source pipelines in defense sectors.

- Financial and Operational Impacts: Pauses or cancellations could disrupt cash flow, especially if primes scale back 8(a) subcontracting. Legitimate firms proving in-house capability and merit may gain advantages in a lethality-focused environment.

- Policy Stability: The program endures, with the SBA encouraging use for mission-critical needs. However, evolving guidelines and potential NDAA changes could refine focus on economic disadvantage.

These developments aim to restore efficiency and accountability, but they demand swift adaptation.

Actionable Steps to Protect and Position Your Business

Focus on these priorities to strengthen your standing:

- Strengthen Compliance Foundations: Conduct an internal review of subcontracting ratios, Cost Accounting Standards (CAS), and indirect rates (overhead, fringe, G&A per FAR Part 31). Document social/economic disadvantage thoroughly via SBA's Certify platform. Engage an independent auditor to simulate a DoW-style review and remediate issues proactively.

- Diversify Revenue Streams: Pursue competitive opportunities within DoW and across agencies via SAM.gov. Explore alignments with veteran priorities (e.g., SDVOSB certification) or non-defense sectors where 8(a) remains strong.

- Enhance Financial Resilience: Optimize indirect rates for competitive pricing in open bids. Model scenarios for 20-50% revenue risk from DoW contracts—build reserves, secure credit, and refine wrap rates to maintain margins.

- Stay Informed and Engaged: Monitor SBA updates, Federal Register notices, and industry associations. Network for warfighting-aligned opportunities and advocate through channels like the National 8(a) Association.

- Long-Term Strategy: Invest in in-house capabilities to reduce subcontracting reliance. Prepare for post-8(a) graduation by building a track record in merit-based competitions.

By addressing these now, you can turn scrutiny into a catalyst for stronger, more sustainable growth. We've walked many executives through similar transitions—compliance challenges often become the foundation for lasting success.

Wallace Angel

Wallace “Wally” Angel is a strategic CPA with more than 20 years of experience in the government contracting and consulting environments with companies ranging from start-ups to $800M. His government contracting expertise includes FAR and DCAA compliance, indirect rate calculation, forward pricing, proposal writing, pricing, and cradle to grave contracts management and system design and implementation. In his position as Partner, Financial Operations, Wally serves as a trusted advisor to the C-suite in controllership and cash management, revenue recognition, system design and implementation, and full financial planning and analysis.

Share this article:

Visit Us On: