DHS Shutdown Threat: What Government Contractors Need to Do Right Now

By WALLY ANGEL, ROSE FINANCIAL SOLUTIONS

When Congress passed the continuing resolution on February 3 to end the broader government shutdown, most of Washington exhaled. What got buried in the headlines: DHS was only funded for two weeks. While the rest of the federal government received funding through September, the Department of Homeland Security's appropriations expire at midnight on February 14. That's two days from now, and negotiators are nowhere close to a deal.

If you hold DHS contracts, your countdown started the day that CR passed. You just may not have noticed.

What's Actually Happening

Congress deliberately separated DHS funding from the broader CR, creating a two-week window to resolve a standoff over immigration enforcement policy. That window is closing fast. On Monday night, Democrats rejected the White House's counterproposal on ICE reforms as "incomplete and insufficient." Senate Majority Leader John Thune acknowledged: "We aren't anywhere close to having any sort of an agreement."

The lapse would affect DHS and its component agencies: ICE, CBP, TSA, FEMA, the Coast Guard, CISA, and the Secret Service. DHS's annual budget is approximately $62 billion, with a significant portion flowing through contracts. One complication: ICE received $75 billion in supplemental funding through the reconciliation bill, so many immigration enforcement functions would continue during a lapse. But contractors supporting TSA, FEMA, Coast Guard, CISA, or other civilian DHS operations don't benefit from that - those programs go dark.

A DHS-only shutdown also creates unique complexity: your non-DHS work continues normally while your DHS portfolio stops. That split causes financial and operational problems a full shutdown doesn't.

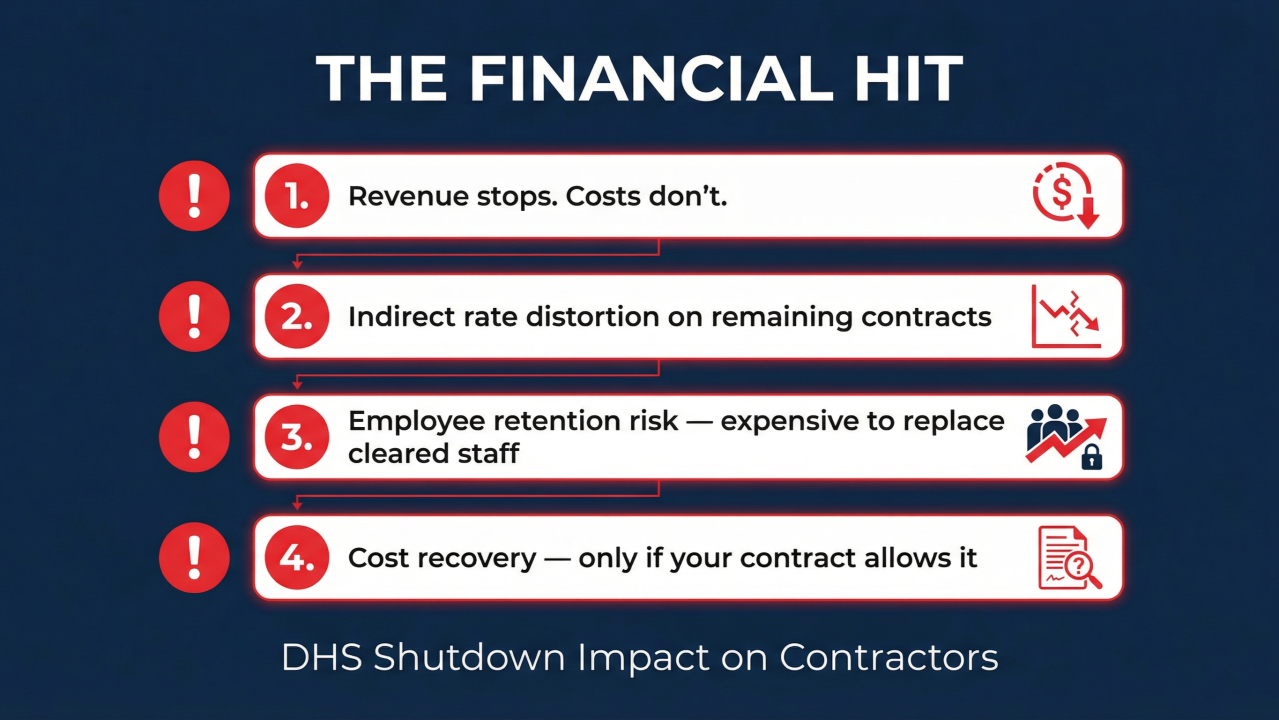

The Financial Hit

- Revenue stops. Costs don't. Your billable hours drop to zero on affected contracts while lease payments, insurance, and salaries continue. If DHS represents 30% of your revenue with a 15% net margin, you're underwater within weeks.

- Indirect rate distortion. When DHS direct labor drops out, your overhead and G&A rates spike on remaining contracts. If you're on cost-reimbursable work with other agencies, they're now absorbing a disproportionate share of your indirect costs. That's a conversation you don't want to have with a DCAA auditor six months from now.

- Employee retention risk. Cleared, credentialed employees on DHS programs can't sit idle - but laying them off means expensive recruiting, clearance processing, and retraining when work resumes. And you may not get them back.

- Cost recovery - if allowable under your contract. Not every contract entitles you to an equitable adjustment, but if yours includes FAR 52.242-15 (Stop-Work Order) and you intend to pursue recovery, start building your case now. Document every incremental cost during the stoppage - idle labor, standby charges, restart expenses. You can't file the claim until work resumes, but what you capture today determines what you recover later.

Your Action Checklist

Contract Review (Now)

- Pull every DHS contract and subcontract. Identify which contain FAR 52.242-15 (Stop-Work Order), FAR 52.249-2 (Termination for Convenience), and FAR 52.232-22 (Limitation of Funds).

- Map your funding. Fully funded vs. incrementally funded task orders? Unfunded CLINs go first. If you've been performing ahead of funding, stop now.

- Identify your Contracting Officers and get contact info while they're still answering emails.

Financial Triage (This Week)

- Run a 30/60/90-day cash flow projection with DHS revenue at zero.

- Accelerate invoicing, if possible. Submit every billable invoice for work performed through the funding expiration. DHS component agencies have their own submission systems - get everything queued before operations wind down.

- Review your credit facility. Know what's available on your line of credit. Talk to your banker now - not after they've read the same headlines and started asking about your portfolio concentration.

- Model your indirect rate impact. Recalculate provisional billing rates excluding DHS direct labor. Determine if you need to notify other agency COs.

Workforce Planning

- Do NOT issue blanket layoffs. Explore redeployment to non-DHS contracts, overhead bench time, accrued PTO, or temporary reduced schedules first.

- Communicate with your team. If they don't hear from you, they'll hear from recruiters.

Documentation (Start Now)

- Start a shutdown cost ledger. Idle labor, facility costs, subcontractor standby charges, stop/restart admin costs. This is the foundation for your equitable adjustment claim once work resumes.

- Document government communications. Every email, call, and non-response. If work stops without a formal stop-work order because your COR is furloughed, document the constructive stop-work.

- Preserve incurred cost records. Actual indirect rates will diverge from provisional rates. Clean documentation prevents audit findings later.

Subcontractor Management

- Flow down the stop-work to subs immediately upon receipt.

- Check sub agreements for stop-work and termination provisions - you're liable for subs' reasonable shutdown costs if your prime entitles you to recover them.

The Bottom Line

A DHS shutdown is an operational event with immediate P&L impact. The political dynamics are working against a quick resolution, and none of them help you make payroll.

If Friday comes and goes without a deal, you want to be the contractor who already invoiced, already modeled the rate impact, already talked to your bank, and already started your cost ledger. Not the one scrambling on Monday the 17th.

Two days. Use them.

Wallace Angel

Wallace “Wally” Angel is a strategic CPA with more than 20 years of experience in the government contracting and consulting environments with companies ranging from start-ups to $800M. His government contracting expertise includes FAR and DCAA compliance, indirect rate calculation, forward pricing, proposal writing, pricing, and cradle to grave contracts management and system design and implementation. In his position as Partner, Financial Operations, Wally serves as a trusted advisor to the C-suite in controllership and cash management, revenue recognition, system design and implementation, and full financial planning and analysis.

Share this article:

Visit Us On: