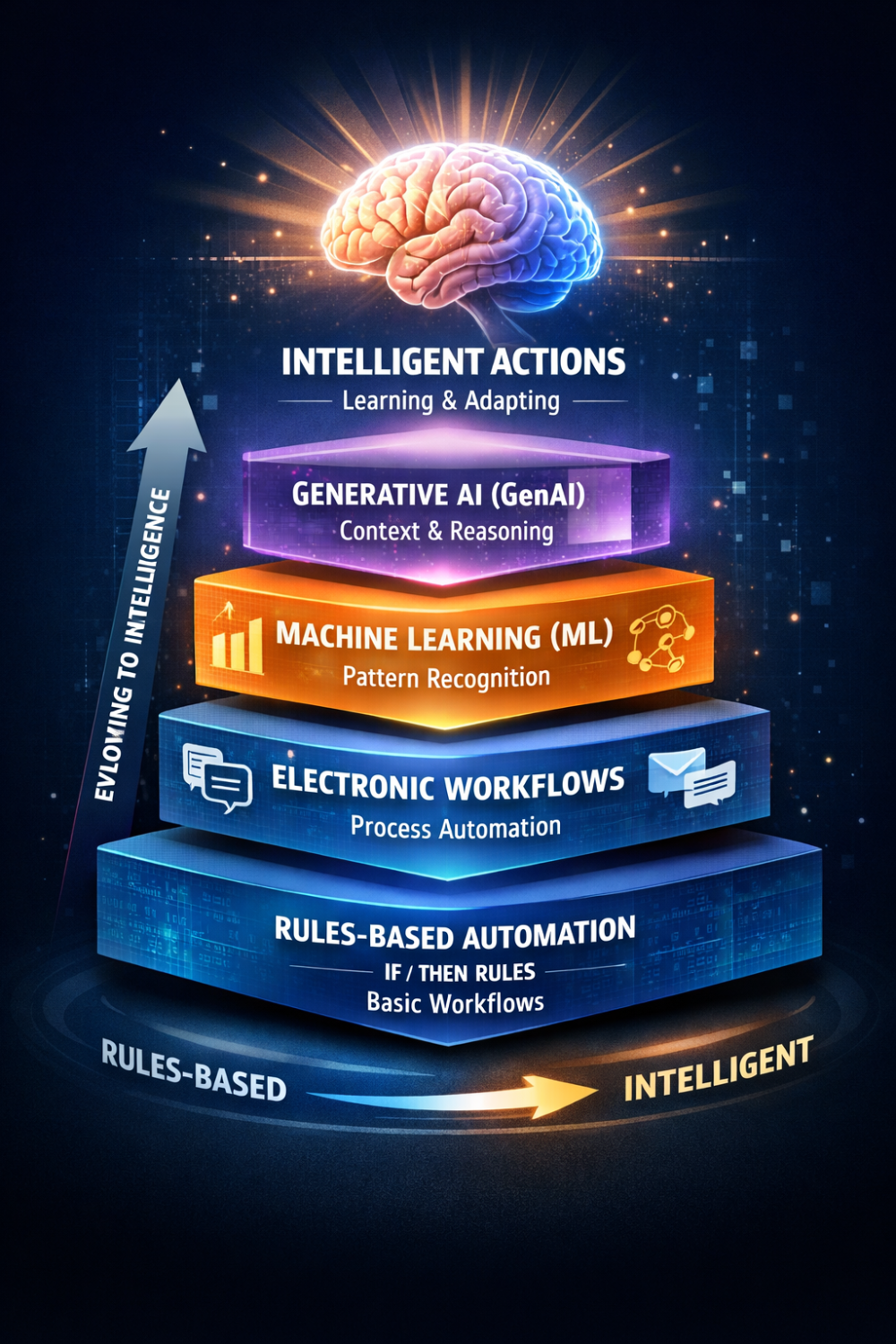

The AI Stack: From Rules-Based Automation to Intelligent Finance Agents

By TED ROSE, ROSE FINANCIAL SOLUTIONS

How Workflow, Machine Learning, and Generative AI Are Eliminating Busy Work — Without Losing Control

For years, finance automation meant one thing: workflow. Tasks moved from one person to another. Rules were applied. Approvals were logged. Reports were generated.

It helped — but it didn’t fundamentally change how finance teams work.

Now it’s different. Task-specific AI agents are emerging as the next layer of digital finance infrastructure. And they are not just automating tasks. They are executing them intelligently.

What Are Task-Specific AI Agents?

Task-specific AI agents are purpose-built digital workers that manage repeatable finance processes end-to-end. Examples include:

- Month-end close agents

- AP exception resolution agents

- Revenue reconciliation agents

- Forecast reconciliation agents

These agents don’t replace finance professionals. They remove the manual burden around them.

Think of them as autonomous operators inside your finance system — continuously monitoring, reconciling, validating, escalating, and learning.

How AI Agents Actually Work

Modern AI agents are not just chatbots. They are built on four integrated layers:

1. Electronic Workflow:

Structured process orchestration Task routing, approvals, escalations, audit trails

2. Machine Learning (ML): Pattern recognition and anomaly detection Trend identification across transactions and accounts

3. Generative AI (GenAI):

Natural-language reasoning Drafted explanations Policy interpretation Intelligent summarization Context-aware recommendations

4. Automation Infrastructure: API integrations System-to-system execution Data synchronization across platforms

When combined, these layers transform static, rules-based automation into adaptive, intelligent action.

From Rules-Based to Learning-Based Execution

Traditional workflow automation follows fixed rules:

- If A happens → do B If variance > X → send alert

- That works — until something unexpected occurs.

- Generative AI changes the model.

Instead of simply applying predefined logic, AI agents can:

- Interpret context

- Compare current activity to historical patterns

- Detect anomalies across multiple systems

- Draft explanations automatically

- Escalate only when judgment is required

- Learn from human feedback

This turns rule-based execution into learning-based execution. An agent monitoring revenue doesn’t just flag a mismatch. It can:

- Trace the issue across systems of record

- Identify likely root causes

- Suggest resolution steps

- Notify the appropriate stakeholder

- Update its logic based on the final human decision

That’s not automation. That’s intelligent finance infrastructure.

What This Means for Finance Teams

People Humans oversee, review, and decide. Agents execute. Finance professionals spend less time reconciling and more time analyzing. Process Repeatable tasks are handled end-to-end by agents. Exceptions are escalated with context and recommendations.

Close cycles accelerate. Errors decline. Surprises decrease. Technology AI agents sit on top of existing systems of record. They do not replace ERP, accounting, or billing platforms.

They monitor, interpret, and act across them. Data Every action creates feedback. Every correction improves the model. The system becomes more intelligent over time.

The Real Outcome: Productivity Without Risk

The biggest fear around AI in finance is loss of control. Task-specific agents are built to do the opposite.

- Every action is logged.

- Every decision is traceable.

- Escalations are structured.

- Humans retain final authority.

The result is major productivity gains without sacrificing governance, compliance, or auditability. Finance doesn’t become less controlled. It becomes more controlled — with fewer manual touchpoints.

2026: The Inflection Point

We are entering the phase where AI agents move from experimentation to infrastructure. In 2026, these capabilities will be deployed at scale inside platforms like Easby and across the broader digital enterprise.

Month-end close will compress. Reconciliations will self-heal. Forecast alignment will be continuous. AP exceptions will resolve themselves before humans even see them.

And the most important shift? Finance teams will stop managing process — and start managing outcomes.

The Power Is Just Getting Started

The combination of workflow, machine learning, generative AI, and automation is not incremental improvement. It is architectural change.

Finance is moving from:

Manual execution → Structured workflow → Intelligent agents

The next generation of finance leaders will not manage tasks. They will manage AI-powered systems that execute tasks continuously.

And the organizations that adopt this early will operate faster, cleaner, and with greater clarity than those who wait. The power is not theoretical anymore.

It’s being built. And 2026 is when it gets unleashed.

Ted Rose

In 1994 Ted Rose founded Rose Financial Solutions (ROSE), the Premier U.S. Based Finance and Accounting Outsourcing Firm. In 2010, the Blackbook of Outsourcing named ROSE the #1 FAO firm in the world based on client satisfaction. As the president and CEO of ROSE, he provides executives with financial clarity. Ted has also acted as the CFO for a number of growth companies and assisted with various rounds of financing and M&A transactions.

Share this article:

Visit Us On: