Conference Recap: Key Insights from the ROSE FaaS Conference

By TED ROSE, ROSE FINANCIAL SOLUTIONS

Last week, industry leaders, CFOs, and GovCon experts gathered for an impactful afternoon of financial strategy, innovation, and executive networking. This high-impact event was designed to help government contractors, nonprofits, and growth-focused businesses navigate financial strategy, industry trends, and AI-driven solutions.

-------

The Strategic CFO Playbook: Scaling Financial Leadership from Start-up to $100M+

Ted Rose, President and CEO of Rose Financial Solutions, opened with a powerful session on the future of financial leadership. From the Five Pillars of Modern Finance to the shift from labor to automation arbitrage, his message was clear: growth requires both structure and innovation.

Harnessing the Power of LinkedIn for Contractors…and others!

Mark Amtower, Consultant, GovCon Influencer, Strategist and Founder of Amtower & Company showed us how to refine our digital presence to build thought leadership, especially in the GovCon space. His insights on leveraging LinkedIn and adapting marketing strategies in an evolving political landscape resonated across the board.

Navigating M&A Trends in Government Contracting

Wallace Angel, VP, Finance and Accounting and Client CFO of Rose Financial Solutions, moderated a dynamic panel with Cedric Powell and Matthew Brom. They covered everything from emerging M&A trends and SBA rule changes to positioning companies for successful exits in the coming years.

Featured panelists included:

- Cedric A. Powell, Partner, Private Equity, M&A, Sheppard Mullin Richter & Hampton LLP

- Matthew Brom, Investment Banker, G Squared Capital Partners

AI and Automation Technologies Available Today

Kimberly Kuchman, MBA, MST VP, Transformations and Product at Rose Financial Solutions, spotlighted real AI and automation use cases in finance—offering a clear view into how automation can streamline processes without compromising control.

Impact of the Trump Administration on Growing Businesses

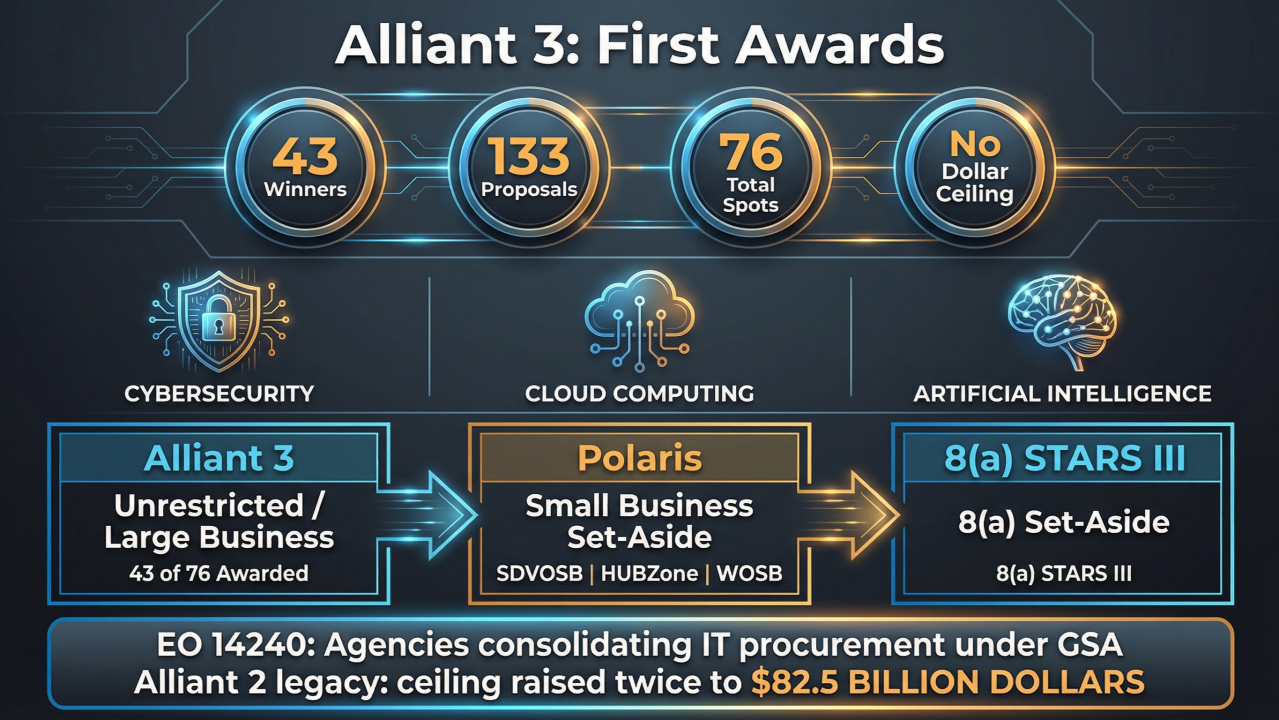

Eric Coffie, The GovCon Giant, Founder & Chief Executive Officer of GovCon Giants energized the audience with actionable strategies for small and mid-sized businesses navigating federal opportunities during the Trump administration.

Scaling Finance & Accounting Infrastructure

Tim Fargo led a thoughtful discussion with panelists Jeff Brown and Wilson Geong on how data, KPIs, and system evolution are driving smarter financial decisions.

Featured panelists included:

- Jeffrey F. Brown, President, Founder, XCAL Shooting Sports and Fitness

- Wilson Geong, Vice President, Finance and Administration, Prison Fellowship International

The Pillars of Financial Management Are the Pillars of Corporate Growth

Ted Rose returned to wrap the day with a challenge: assess your organization’s maturity across people, process, technology, organization, and data—because they’re the backbone of scalable growth.

📢 Join ROSE Business Forum & Events to gain more exclusive access to conference resources, industry insights, discussions, and networking opportunities tailored for GovCons, Nonprofits, and Growing Businesses.

Share this article:

Visit Us On: