IRS Updates: Key Tax Deadlines | Guidance Under the CARES Act

On April 9, 2020, the Internal Revenue Service (IRS) announced additional key tax deadlines for individuals and businesses as well as guidance under the CARES Act to taxpayers with net operating losses.

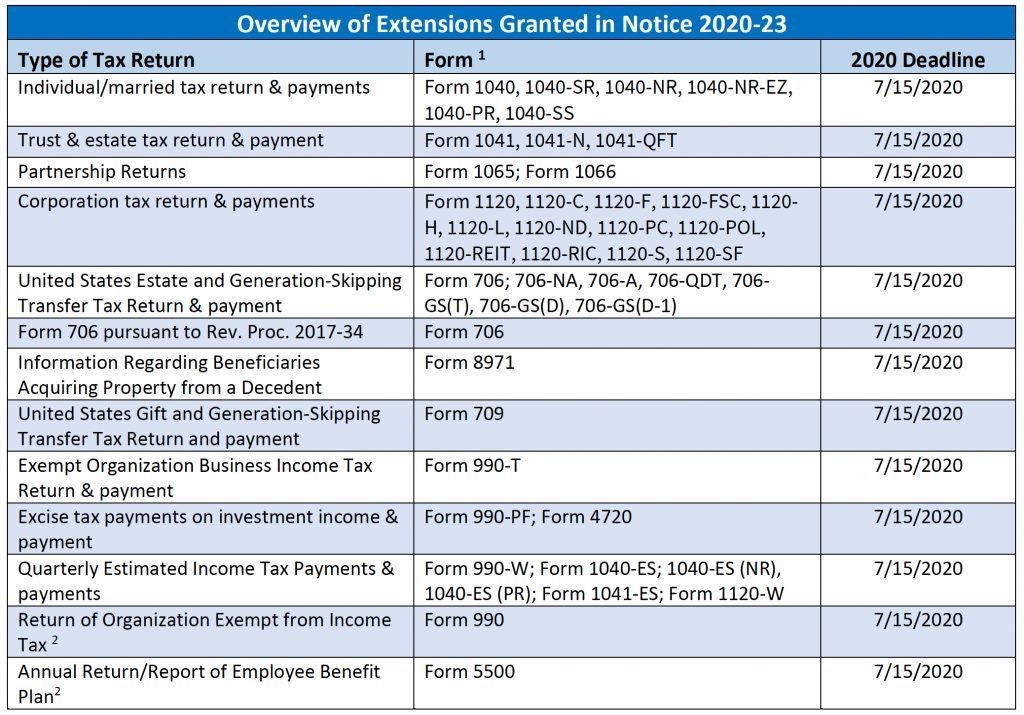

IRS extends more tax deadlines to cover individuals, trusts, estates corporations and others

To help taxpayers, the Department of Treasury and the IRS announced yesterday that Notice 2020-23

extends additional key tax deadlines for individuals and businesses.

Last month, the IRS announced that taxpayers generally have until July 15, 2020, to file and pay federal income taxes originally due on April 15. No late-filing penalty, late-payment penalty or interest will be due.

Yesterday’s notice expands this relief to additional returns, tax payments and other actions. As a result, the extensions generally now apply to all taxpayers that have a filing or payment deadline falling on or after April 1, 2020, and before July 15, 2020. Individuals, trusts, estates, corporations and other non-corporate tax filers qualify for the extra time. This means that anyone, including Americans who live and work abroad, can now wait until July 15 to file their 2019 federal income tax return and pay any tax due.

Extension of time to file beyond July 15

Individual taxpayers who need additional time to file beyond the July 15 deadline can request an extension to Oct. 15, 2020, by filing Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov. Businesses who need additional time must file Form 7004. An extension to file is not an extension to pay any taxes owed. Taxpayers requesting additional time to file should estimate their tax liability and pay any taxes owed by the July 15, 2020, deadline to avoid additional interest and penalties.

Estimated Tax Payments

Besides the April 15 estimated tax payment previously extended, yesterday’s notice also extends relief to estimated tax payments due June 15, 2020. This means that any individual or corporation that has a quarterly estimated tax payment due on or after April 1, 2020, and before July 15, 2020,can wait until July 15 to make that payment, without penalty.

2016 unclaimed refunds – deadline extended to July 15

For 2016 tax returns, the normal April 15 deadline to claim a refund has also been extended to July 15, 2020. The law provides a three-year window of opportunity to claim a refund. If taxpayers do not file a return within three years, the money becomes property of the U.S. Treasury. The law requires taxpayers to properly address, mail and ensure the tax return is postmarked by the July 15, 2020, date.

1 – This relief includes not just the filing of specified Forms, but also all schedules, returns, and other forms that are filed as attachments to specified forms or are required to be filed by the due date of Specified Forms

2 – This relief comes through Rev. Proc. 2018-58 for affected taxpayers with a time sensitive which is due to be performed on or after April 1, 2020.

NOTE: The above list is not intended to be all inclusive. Rev. Proc. 2018-58 provides other disaster-related relief for time-sensitive actions and elections.

IRS provides guidance under the CARES Act to taxpayers with net operating losses

The IRS yesterday issued guidance providing tax relief under the CARES Act for taxpayers with net operating losses. Recently the IRS issued tax relief for partnerships filing amended returns.

COVID Relief for taxpayers claiming NOLs

Revenue Procedure 2020-24

provides guidance to taxpayers with net operating losses that are carried back under the CARES Act by providing procedures for:

- waiving the carryback period in the case of a net operating loss arising in a taxable year beginning after Dec. 31, 2017, and before Jan. 1, 2021,

- disregarding certain amounts of foreign income subject to transition tax that would normally have been included as income during the five-year carryback period, and

- waiving a carryback period, reducing a carryback period, or revoking an election to waive a carryback period for a taxable year that began before Jan. 1, 2018, and ended after Dec. 31, 2017.

Six month extension of time for filing NOL forms

In Notice 2020-26

, the IRS grants a six-month extension of time to file Form 1045 or Form 1139, as applicable, with respect to the carryback of a net operating loss that arose in any taxable year that began during calendar year 2018 and that ended on or before June 30, 2019. Individuals, trusts, and estates would file Form 1045

, and corporations would file Form 1139.

COVID relief for partnerships with NOLs

On April 8, 2020, the IRS issued Revenue Procedure 2020-23

, allowing eligible partnerships to file amended partnership returns using a Form 1065, U.S. Return of Partnership Income, by checking the “Amended Return” box and issuing amended Schedules K-1, Partner’s Share of Income, Deductions, Credits, to each of its partners. Partnerships filing these amended returns should write “FILED PURSUANT TO REV PROC 2020-23” at the top of the amended return.

Share this article:

Visit Us On: