Easby: Your CFO Copilot for a More Agile, Proactive Finance Function

By TED ROSE, ROSE FINANCIAL SOLUTIONS

As finance leaders face mounting complexity and shifting expectations, a critical question arises: How can we stay proactive and agile in a fast-moving environment?

At ROSE, client feedback has made it clear—finance teams don’t just need accounting software (the "System of Record"). They need a partner. That’s why

Easby has evolved into a true "System of Engagement": a CFO Copilot that streamlines financial operations, enhances visibility, and empowers faster, smarter decision-making.

While Easby was designed with CFOs in mind, it goes beyond finance. CEOs, COOs, and other senior leaders rely on Easby to:

- Consolidate financial data

- Stay informed and accelerate approvals

- Reduce administrative burdens

- Enable more responsive leadership across the organization

Today’s executives—from government contractors to high-growth startups and nonprofits—are turning to Easby to manage finance, accounting, and tax functions with greater clarity, speed, and control. And it keeps getting better!

What’s New in Easby 25.1 – May 2025 Release

The latest release focuses on three client priorities: accessibility, transparency, and operational efficiency. Here’s what’s included:

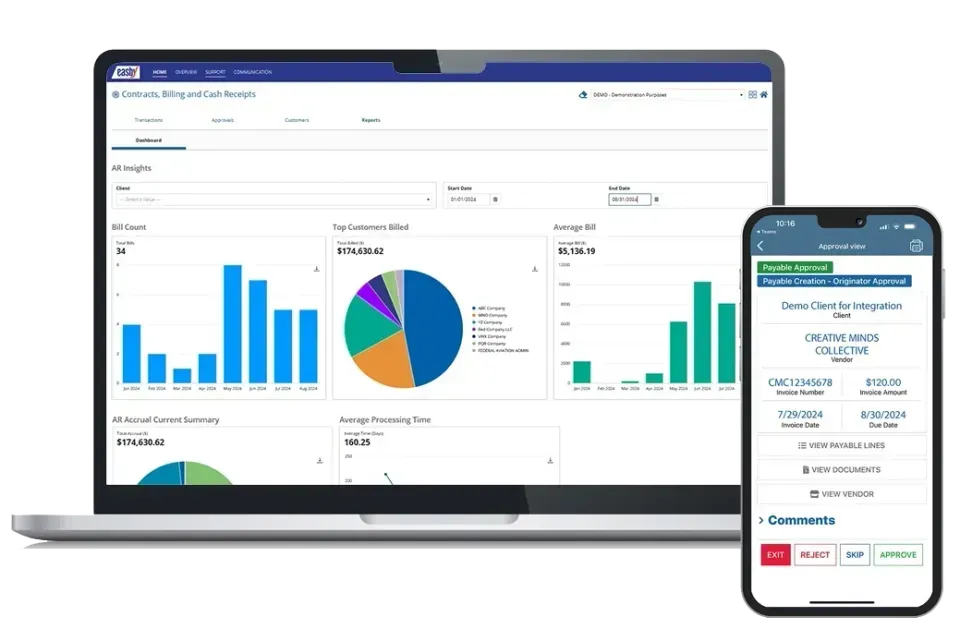

📱 Mobile Access: Stay Connected Anytime, Anywhere

Easby’s mobile app keeps executive and finance teams plugged in on the go. Approve transactions, review reports, and track key activities whether you’re traveling or managing offsite. With Easby mobile, leaders can stay informed and responsive—no matter where business takes them.

📊 Real-Time Dashboards: Instant Insights at Your Fingertips

Easby introduces expanded visual dashboards that provide real-time visibility into key performance indicators across financials, payables, billings, payroll, and compliance. Evaluate trends, monitor metrics, and spot risks without waiting for static reports.

📄 On-Screen Financial Statements: Dynamic, Integrated Reporting

Access current and historical financial statements directly inside Easby—eliminating the lag and limitations of static PDFs. This feature supports faster, more integrated financial reviews across teams.

🔗 ERP Integrations: Real-Time Data You Can Trust

Easby connects with Procas, QuickBooks, Unanet, Intacct and Deltek Costpoint (with more ERP platforms coming soon), delivering a centralized, real-time view of financial operations. By syncing with your existing systems, Easby improves data reliability and simplifies analysis.

🔍 Process Insights: End-to-End Financial Transparency

Gain visibility across the entire finance cycle—accounts payable, accounts receivable, payroll, and monthly close processes. Easby tracks task progress, outstanding items, and bottlenecks, helping leaders oversee financial operations with confidence.

🤖 Intelligent Document Processing: Smarter AP Automation

Easby replaces traditional OCR tools with IDP (Intelligent Document Processing) to automate invoice extraction, reduce manual entry, and improve accuracy in accounts payable workflows.

⚙️ AI Smart Tools: Simplify Reviews and Reporting

New automation features help you:

- Summarize financial data and comments faster

- Consolidate documentation

- Answer your financial questions instantly

These AI-powered tools reduce friction from reporting cycles and internal reviews, putting the power of your financial data at your fingertips.

🔒 Integration and Interface Upgrades

- Bill.com Integration: Expanded visibility into payables, now with multi bank account support.

- DocuSign Integration: Secure electronic signatures for approvals, sign-offs, and filings.

- New Home Page Design: Faster access to dashboards, financial data, and essential functions.

- Stronger Security: Expanded multi-factor authentication.

- Enhanced Help Center: More tutorials and in-app guides in the ROSE Community.

🗓️ Compliance Reporting: Always Ready, Always Compliant

Access real-time tax and compliance reporting to meet audit requirements and regulatory deadlines with greater ease.

What’s Coming in Easby 25.2 – Winter 2025

Looking ahead, Easby will continue evolving with features designed for deeper insights, greater customization, and interactive data experiences:

✅ Customizable Dashboards: Tailor dashboards and KPIs to match your organization’s reporting needs.

✅ Live Drill-Downs: Click straight into transaction-level details from dashboards and reports.

✅ AI Chat Assistant: Query more financial data and documents conversationally for instant answers.

✅ Expanded ERP Syncing: Deeper integrations with Unanet, Deltek Costpoint, Sage Intacct, and more.

✅ Document Viewing Enhancements: Faster access to key documents through tabs and quick links.

✅ Audit Trail Reporting: Consolidate transaction history, approvals, and documentation into one exportable file.

✅ Refreshed Banking Interface: Monitor all account connections and activities from a single... Read more in the ROSE Community.

Want to read the full article?

📢 Join ROSE Business Forum & Events to gain exclusive access to industry insights, discussions, and networking opportunities tailored for GovCons, Nonprofits, and Growing Businesses.

Ted Rose

In 1994 Ted Rose founded Rose Financial Solutions (ROSE), the Premier U.S. Based Finance and Accounting Outsourcing Firm. In 2010, the Blackbook of Outsourcing named ROSE the #1 FAO firm in the world based on client satisfaction. As the president and CEO of ROSE, he provides executives with financial clarity. Ted has also acted as the CFO for a number of growth companies and assisted with various rounds of financing and M&A transactions.

Share this article:

Visit Us On: